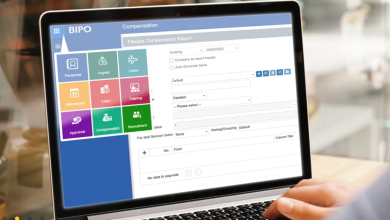

Unveiling the Secrets of the Share Bazaar: Demystifying Complex Trading Concepts with Trading Apps

The shared bazaar can often seem like a mysterious and complex world, filled with esoteric trading concepts and jargon. However, trading apps have emerged as powerful tools that can demystify these complexities and provide investors with a user-friendly platform to navigate the share market. Use the Indian stock market app for your ease. This article aims to unveil the secrets of the share bazaar by demystifying complex trading concepts with the help of trading apps. From understanding order types and technical analysis to exploring risk management strategies, trading apps offer valuable resources to help investors gain confidence and make informed trading decisions.

Understanding Order Types

One of the fundamental concepts in share trading is understanding different order types. Trading apps provide clear explanations and options for various order types, such as market orders, limit orders, stop-loss orders, and trailing stop orders. Investors can easily select the appropriate order type based on their trading strategy and risk tolerance. Furthermore, trading apps often offer features like order duration, allowing investors to specify the duration of their orders, such as day orders or good-till-canceled orders. Use the Indian stock market app for your ease. By demystifying the various order types, trading apps empower investors to execute trades with precision and confidence.

Utilizing Technical Analysis Tools

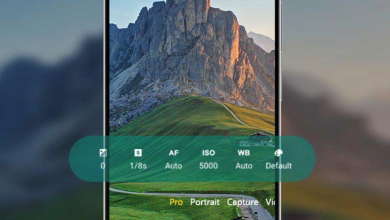

Trading apps come equipped with a wide range of technical analysis tools to help investors understand market trends and make more informed trading decisions. These tools include charting features, indicators, and drawing tools that allow investors to analyze price patterns, identify support and resistance levels, and track momentum. With the help of trading apps, investors can demystify technical analysis concepts and gain insights into market behavior. Use the Indian stock market app for your ease. By utilizing these tools effectively, investors can identify potential entry and exit points, set stop-loss levels, and make more informed trading decisions based on technical indicators.

Exploring Risk Management Strategies :

Risk management is a crucial aspect of share trading, and trading apps can assist investors in understanding and implementing effective risk management strategies. These apps provide features such as setting stop-loss levels, calculating position size based on risk tolerance, and offering risk-reward ratio analysis. By demystifying risk management concepts and providing user-friendly tools, trading apps help investors protect their capital and manage risk effectively. Investors can set predefined risk limits, diversify their portfolios, and implement risk management strategies with ease, ultimately enhancing their overall trading performance. Use the Indian stock market app for your ease.

Accessing Real-Time Market Data

Trading apps provide investors with real-time market data, including stock prices, order book depth, and other relevant market information. This real-time data allows investors to stay informed about market trends, price movements, and news that may impact their trading decisions. Use the Indian stock market app for your ease. With trading apps, investors can access comprehensive market data, including historical price charts and market news, all in real-time. By demystifying the complexities of data analysis and providing up-to-date information, trading apps empower investors to make timely and well-informed trading decisions.